Our current economic system is based on linear growth and consumption. Our planetary resources however are limited and running out. To keep our planet liveable for both current and future generations, the prevailing paradigm is untenable and asks for change. This, in short, sums up the need for a sustainable economy, to which the financial sector can be a driving force.

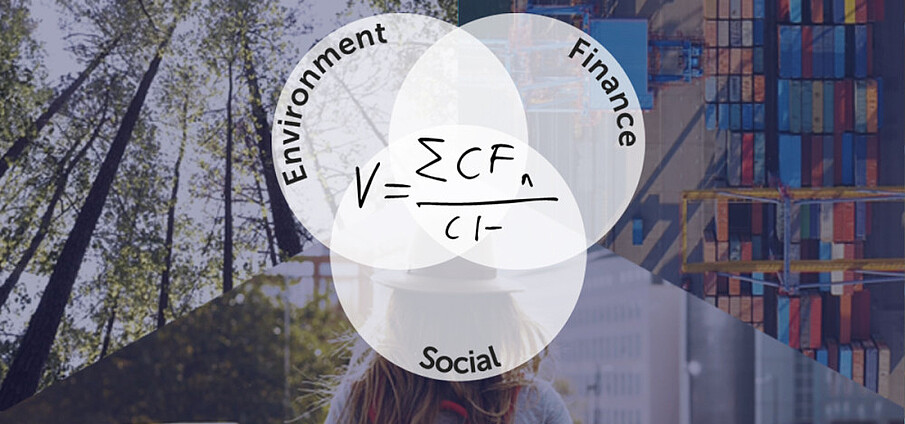

The key driver for sustainable development is integrated thinking. Integrated thinking in finance requires, first and foremost, a mindset that is open to integrate the social foundations and the planetary boundaries into finance. The Platform promotes integrated thinking in finance by combining financial, social and environmental returns.

Dirk Schoenmaker, Academic Director of the Erasmus Platform for Sustainable Value Creation

Online Course: Sustainable Corporate Finance

In today’s rapidly evolving business environment, sustainability is no longer an option – it’s a critical driver of long-term success. This course equips you with the knowledge to navigate the growing demand for sustainable business practices. You learn how to incorporate social and environmental value alongside financial metrics, using established corporate finance methods.

Latest Blogs

Webinars

SEC vs CSRD: Expert Views on Transatlantic ESG Disclosure Regulation

Are you curious about recent sustainability reporting regulations? Learn more about the challenges, opportunities and perspectives of the different approaches adopted by the U.S. Securities & Exchange Commission (SEC) and the European Union's Corporate Sustainability Reporting Directive (CSRD) in this webinar on sustainable finance policy & regulation.

For more information on this webinar click here.

Find out more about our executive education programme: Sustainable Finance

Who we are

Our work

Project Manager Erasmus Platform for Sustainable Value Creation

Office Manager