Is this option suitable for me?

At Rotterdam School of Management, Erasmus University (RSM), we value the diverse needs of our participants. For our post-experience programmes, the following can be said about VAT. Our NVAO-accredited post-initial degree programmes, such as our MBA’s, are always offered exempt from VAT. All other executive education courses are in principle taxed with 21% VAT. A VAT exemption is beneficial for individuals and for organisations that cannot reclaim VAT. In that case, a 10% surcharge will be added to the VAT-exempted price. This means a major advantage compared to the price including VAT.

Examples of entities that may benefit from this arrangement are:

- individuals

- medical, social, and cultural sectors

- banking and insurance industry

- government institutions

- educational organisations.

RSM VAT exemption in a nutshell

Why do I pay a 10% VAT surcharge?

Offering our participants a VAT-exempted price means that we, as an organisation, cannot fully reclaim the VAT paid on our procurement costs (such as expenses for instructors, course materials, and venues). This would be possible if we applied VAT to all prices. By providing a VAT-exempted price to our participants, our procurement costs increase, as we cannot reclaim a portion of the VAT on these costs. To cover the higher procurement costs, we apply the 10% VAT surcharge. Rest assured, this is in complete accordance with the Dutch Tax Authorities.

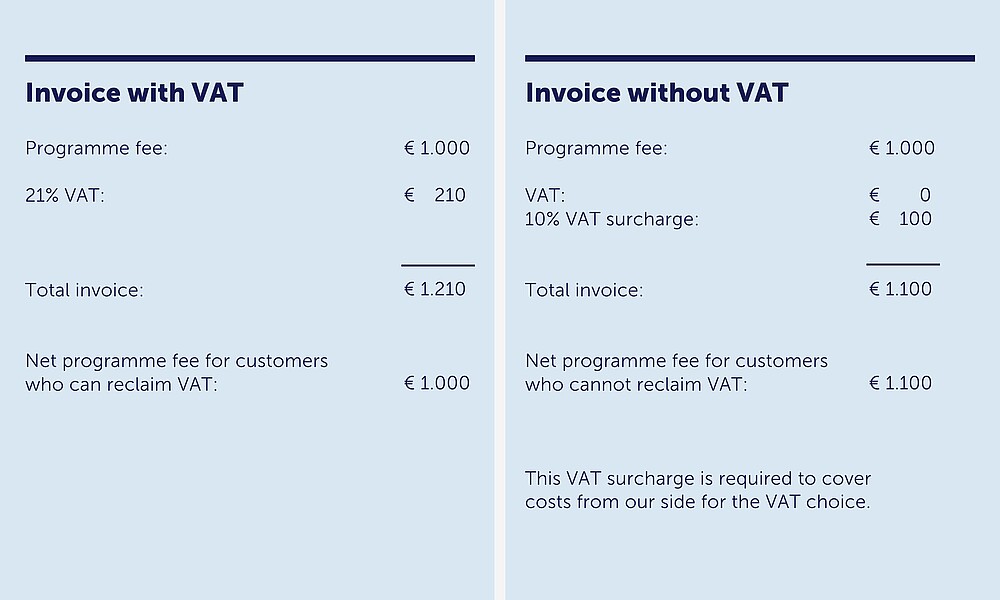

VAT Calculation Example

All amounts stated on our website are exclusive of VAT.

How do I indicate my preference?

During the finalisation of your registration, you can specify your preference:

- Invoice with 21% VAT; or

- Invoice without VAT but inclusive of a 10% VAT surcharge.

NVAO-accredited post-initial degree programmes and VAT-inclusive executive education are offered by Rotterdam School of Management BV. If you choose a VAT-exemption, the provider of the programme is RSM Executive Education BV.