The creation and development of global supply chains has been one of the human race's great success stories in terms of economic advancement. But illicit activities like counterfeiting and trafficking are widespread problems and threaten standards everywhere. Albert Veenstra, Professor of Trade and Logistics, and Associate Professor of Supply Chain Management Morteza Pourakbar at RSM have delved into the central question of how customs agencies could design an incentive structure so that companies are encouraged to adopt standards to deter bad actors – and to incur the costs of implementing them.

The creation and development of global supply chains has been one of the human race's great success stories in terms of economic advancement. But illicit activities like counterfeiting and trafficking are widespread problems and threaten standards everywhere. Albert Veenstra, Professor of Trade and Logistics, and Associate Professor of Supply Chain Management Morteza Pourakbar at RSM have delved into the central question of how customs agencies could design an incentive structure so that companies are encouraged to adopt standards to deter bad actors – and to incur the costs of implementing them.

Recognising that differences around the world can be harnessed for economic benefit is not new, but recent developments have been at an accelerated rate. The creation and development of global supply chains is generally credited with increasing efficiency through benefitting from cheap labour and resources, having access to skills, technologies and knowledge or even macroeconomic forces such as trade agreements.

There have been benefits to all parties involved. However, not everything is necessarily golden in the global supply chain. One very significant drawback is that firms may lose control and visibility over their complex supply chains. Elements, especially intercontinental transport links, are vulnerable to 'bad actors', such as terrorists, counterfeiters, traffickers and smugglers. This may have driven an increase in disreputable working practices such as the infringement of intellectual property (IP) rights, counterfeiting, and illicit trading.

Based on customs seizures, the Organisation for Economic Co-operation and Development (OECD) estimates that the total value of counterfeit and pirated articles traded internationally in 2019 amounted to more than US$464 billion, or 2.5 per cent of world trade. Nowadays, counterfeiting risk is not only relevant for fashion and luxury goods but it has become prevalent in many other sectors including sensitive ones such as aviation, pharmaceuticals, electronics and automotive. Counterfeiting can harm the reputation of the original manufacturers, but it can also endanger front-line workers if health and safety considerations are ignored. End customers could also be exposed to unquantified risk if the counterfeited items are substandard – imagine the damage from counterfeit car brake pads that cannot do the job.

The most pressing question for firms and governments is how to manage and mitigate the risks of illicit activities such as counterfeiting. Globalisation adds to the complexity of this task.

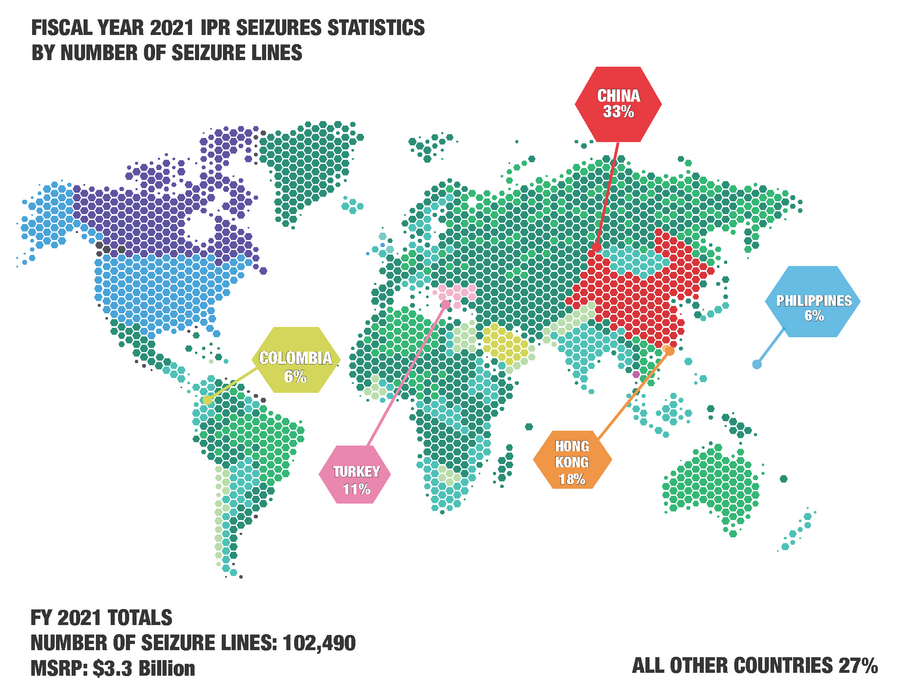

Almost 70 per cent of all counterfeits seized worldwide come from China and other low-wage countries where IP protection is weak. Cultural and political reasons make it difficult to obstruct counterfeiting activities inside these countries.

To combat counterfeiting, firms may decide to have more control of their global supply chains by keeping track of the performance of compliance service providers to gain more control over their business processes along the supply chain. Compliance service providers are parties who specialise in executing compliance procedures (customs declarations and so on) for companies. They are usually specific for a particular country so international firms often use many of them. Firms can also formulate global or corporate policies for compliance and trade management to avoid fines and having shipments seized.

Another plausible solution would be to hinder counterfeits entering final markets. Customs inspections at borders play a prominent role in the fight against counterfeiting. In 2021, US Customs and Border Protection seized a total of 27,115 shipments of goods totalling an estimated US$3.3 billion in suggested retail prices. The demands placed on these customs officials checking imports sit at the heart of the matter. They face a gargantuan task, especially if there is institutionalised failure to accept the parameters that others would impose on them. Often, other agencies are responsible for developing anti-counterfeiting policy but the customs service is the party making seizures at the border, and this can lead to inter-agency friction.

Unfortunately, customs services cannot solve the counterfeiting problem on their own, and the efficiency of customs deterrence activities depends on collaboration with the holders of IP rights. In order to seize counterfeits, customs officials need information about the company’s supply chain, trademarks, and product information – from the company. And companies also need the expertise of customs officials to identify and confiscate copies of their goods.

Without a public-private partnership (PPP), the original equipment manufacturer (OEM) has very limited power to suppress counterfeiting.

Companies need governmental involvement to enforce anti-counterfeiting measures because they can do little themselves with the business levers they have at their disposal, such as pricing. Pricing may offer limited effectiveness as counterfeiters have plenty of leeway to offer attractive prices given their low production costs compared to authentic manufacturers. The researchers also stress the role of punitive measures, a lack of which endangers the effectiveness of PPPs. In other words, as long as counterfeiting is perceived as a low-risk but lucrative business, a PPP would not be able to effectively hinder counterfeiters.

Another form of PPP to combat bad actors and counterfeiters in supply chains is the World Customs Organization’s (WCO) Framework of Standards to Secure and Facilitate Global Trade (SAFE). These are standards for managing risk and security issues in cargo, processes, personnel, and physical assets. In the EU this is called Authorised Economic Operator, and in the USA it’s called Customs Trade Partnership Against Terrorism (CTPAT). They both have tens of thousands of member firms all over the world.

The ultimate goal here is to establish security for all parts of the supply chain, from origin to destination.

It requires governments to delegate the enhancing of risk and security activities to firms.

Implementing these standards is costly to firms, but in return they get benefits such as reduced customs inspection rates.

The central question addressed here by Albert Veenstra and Morteza Pourakbar is how customs should design an incentive structure so that companies are encouraged to incur the costs of implementing these standards.

The researchers identified two categories of incentives to do that.

The first is a tangible operational incentive gained through less frequent inspections and a reduction in waiting time at the point of entry. Customs works on a risk-based approach so if a company is considered to be less risky, then there will be fewer checks.

The second incentive is intangible and asks the firm to better defend its supply chain against counterfeiters.

According to the researchers, the key factor in better security through both of these incentives is the alignment of decisions about the capacity of customs inspections, and what incentives should be offered to firms that comply. The idea is that companies try to do more themselves, but that they need government agencies to respond to this with diversification in their enforcement policies.

Security incentives might benefit all participants, so tailored operational incentives should be used only to foster collaboration.

Lack of capacity for conducting inspections limits the use of the operational incentive – firms are reluctant to participate. But when there is plenty of capacity for inspections, the benefit obtained through certification like Europe’s Authorized Economic Operator (AEO) standard certification scheme is less noticeable and firms are understandably less likely to want to take part.

Underpinning this is what each government decides to do. National standards for inspection rates and capacities can have significant impact on the success or failure of such programmes.

The researchers have shown that mechanisms are in place to combat the problems that have arisen from the growth of global supply chains, and the huge drive to insist on responsible practices, but, they point out, insisting on them is not the same as achieving them. And while there has been a lot of work there is more to be done.

Science Communication and Media Officer

Rotterdam School of Management, Erasmus University (RSM) is one of Europe’s top-ranked business schools. RSM provides ground-breaking research and education furthering excellence in all aspects of management and is based in the international port city of Rotterdam – a vital nexus of business, logistics and trade. RSM’s primary focus is on developing business leaders with international careers who can become a force for positive change by carrying their innovative mindset into a sustainable future. Our first-class range of bachelor, master, MBA, PhD and executive programmes encourage them to become to become critical, creative, caring and collaborative thinkers and doers.